December 30, 2022

Interim results for the six months ended 30 June 2022

La Perla Fashion Holding N.V. (“La Perla” and together with its consolidated subsidiaries, the “Group”), a luxury fashion holding company incorporating La Perla, a leading designer, manufacturer and retailer of luxury lingerie, nightwear and swimwear, and La Perla Beauty, announces results for the six months ended 30 June 2022.

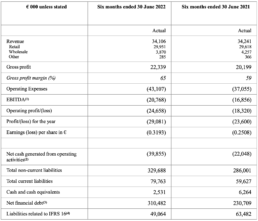

Financial Overview – Consolidated La Perla Group

(1) EBITDA is calculated as Operating Profit/Loss before amortization and depreciation and write-offs

(2) Lease payments of €7.0 million in HY 2022 and €4.0 million in HY 2021 are categorized under Cash flow from financing activities

(3) Net financial debt calculated as Long term borrowings plus Short term borrowings minus Cash and cash equivalents. It excludes Financial lease liabilities

(4) Refers to Financial lease liabilities

Financial review

Although management was encouraged by a continuation of the second half of 2021’s positive trends, the Covid-19 crisis continued to significantly affect results during the first half of 2022, particularly in Asia, where stores and warehouses were closed for extended periods.

Revenue decreased 0%, from €34.2 million to €34.1 million. By channel:

- Retail revenue, year on year, increased 1%,

- By region, while North America and Europe continued to recover strongly, sales in Asia were impacted by the re-introduction of Covid-19 restrictions, particularly in China

- Wholesale revenue decreased by 9%, impacted by both invoicing timing differences and Covid-19 related supply chain disruption

Gross margin increased from 59% to 65%, driven by a greater proportion of full-price sales.

Operating expenses overall increased from €37.1 million in the 2021 period to €43.1 million in 2022. This was driven by additional operating expenses of the new La Perla Beauty business.

Depreciation, amortization and write-off increased from €1.4 million in the first six months of 2021 to € 3.9 million for the same period in 2022. The reduction was primarily driven by the closure of underperforming stores.

The improvement in operating loss resulted from the above factors.

Outlook

Given the continued uncertainty around Covid-19 and the further impact on the economy and consumer spending, the Group cannot adequately determine the future effect on its business. Therefore, La Perla is currently not providing forward guidance. However, La Perla has concluded that it is appropriate to adopt the going concern basis of accounting in preparing the interim results for the six months ended 30 June 2022. Among others, La Perla’s financing arrangements include a loan by Tennor Holding B.V. and La Perla Fashion Finance B.V. in the aggregate principal amount of up to €400 million. The total amount outstanding under this loan stands at €312 million as of 30 June 2021, inclusive of accrued interest and fees.

Media contacts

Seven Dials

Simon Kelner / James Devas:

simon@sevendialspr.com / james@sevendialscity.com / +44 203 740 7493

About La Perla:

La Perla Fashion Holding N.V., a luxury fashion holding company, is the direct shareholder of La Perla Beauty (UK) Limited (“La Perla Beauty”) and La Perla Global Management (UK) Limited and its subsidiaries (the “Operating La Perla Group”). La Perla, through the Operating La Perla Group, is a leading designer, manufacturer and retailer of luxury lingerie, nightwear and swimwear. The group operates under the brand “La Perla”. Founded in 1954 in Bologna, Italy, the brand is renowned for its heritage and craftsmanship.

This release may contain forward-looking statements, i.e., statements that do not relate to historical facts or events. By their nature, forward-looking statements involve known and unknown risks and uncertainties, both general and specific. La Perla Fashion Holding N.V. bases these statements on its current plans, estimates, projections and expectations and they relate to events and are based on current assumptions that may not occur in the future. These forward-looking statements may not be indicative of future performance; the actual outcome of the financial condition and results of operations of La Perla Fashion Holding N.V. and its consolidated subsidiaries, and the development of economic conditions, may differ materially from, in particular be more negative than, those conditions expressly or implicitly assumed or described in such statements. Even if the actual results of the La Perla Fashion Holding N.V. or its consolidated subsidiaries, including the financial condition, results of operations and economic conditions, develop in line with the forward-looking statements contained in this press release, there can be no assurance that this will be the case in the future